Paris, March 28, 2024 – Europ Assistance (“EA”) today announced the international findings of their 2nd edition of the Mobility Barometer. The survey was conducted by Ipsos, a global market research firm, among 8,000 people across 8 countries in Europe: Belgium, France, Germany, Italy, Portugal, Spain, Austria and the Czech Republic. It tracks Europeans’ mobility habits. The survey was taken between December 14th 2023 and January 18th, 2024

The evolutions (+x pts/-x pts) presented with the 2022 results are based only on the same 6 countries tested in 2022 and 2023. The 2023 results presented for Europe are based on the 8 countries tested in 2023.

“We are at a crucial turning point towards transitioning from a carbon-emitting transportation model to one focused on sustainable mobility. While this shift in mindset is not new, it is becoming increasingly tangible in everyday practices. This transition also impacts the assistance market, requiring a profound revision of models to adapt to these changes. At Europ Assistance, we have led the way and are fully prepared to address this challenge”

Cedric Pauly, Global Head of Mobility Business Line

“As a global leader in assistance, we accompany citizens of the world in their travels. It is therefore essential for us to closely monitor the evolution of mobility behaviors. We observe that an increasing number of Europeans are in agreement: sustainable mobility is no longer seen as merely an option, but as the solution to the environmental equation. We are committed to supporting them in this transition and providing solutions that meet their needs”

Anne-Laure Alviset, Global Mobility Marketing Director

While cars are still predominant in Europe, electric bikes are gaining in popularity and become an everyday companion

In 2023, car remains the primary mode of mobility in Europe: they continue to be largely dominant (87% of Europeans own a personal car, and 84% use it daily). Europeans remain attached to their cars: 70% of car owners would not be ready to stop owning a car in the future, a figure that remains stable compared to last year. Among them, 34% are strongly resistant to this idea (“definitely not”).

However, transportation methods involving cars in general (whether it is personal cars, taxis / VTC, or car-sharing) seem to see their usage decline: 26% of personal car users use it less often than 5 years ago, a figure that rises to 32% in France.

In parallel, bicycles, whether standard or electric, are still used by nearly 4 out of 10 Europeans.

While the ownership of standard bikes is decreasing (57% of Europeans own a standard bike in their household, -5 points vs last year), the presence of electric bikes is progressing: now 1 in 5 households in Europe owns an electric bike (19%, +2 points). This trend might be driven by the increasing accessibility and affordability of electric bikes, as well as their enhanced features such as assisted pedaling.

There is also an intensification of the use of electric bikes: 42% of users say they use it more often than 5 years ago, and 32% say they intend to use it more in the future.

More broadly, there is a trend towards a more intense use of soft mobility and public transport in the future: Europeans say that they will use walking (32%), standard bikes (25%), and public transport more frequently in the future (25%), all these modes of transport having a positive “delta” (more often – less often) in future usage intentions.

Finally, mobility still represents a significant budget for Europeans: 147€ per month, a budget that remains stable in most countries this year. The cost of transportation is the main reason to change mobility habits: 35% at the European level, and up to 46% in France.

Electric Vehicles continue to attract a specific segment of population

While ICE (thermic) cars are still predominant, they are beginning to decline (-2 points for Petrol, same for Diesel).

One European out of three (29%) would be interested in acquiring an electric or hybrid vehicle. This figure is relatively stable since last year overall (+1 pt), but some countries see significant progressions (Belgium and Italy + 5 pts each).

People considering the acquisition of electric vehicles are younger, more often active, and urban. If their motivations for considering EV are largely environmental (39% mention ecological reasons), the skyrocketing cost of petrol is also a motivating factor for the transition to electric (43% would do it to save money on fuel costs).

EV considerers are more concerned about the environmental impact of their mobility habits already: 69% of them feel bad about the ecological footprint linked to the usage of their car, vs 48% of the overall population. They also already have more in mind and consider more plausible the future regulations regarding EV: 64% consider that EU regulations imposing the sale of EV by 2035 are realistic and will be applied, vs 41% overall.

The barriers to buying an electric vehicle are primarily driven by the purchase price (even more strongly this year, + 4 pts at the European level). At the same time, difficulties related to charging points are less significant (-3 points).

Towards a safer, more covered usage of micro-mobility devices

Regarding micro-mobility, which includes forms of transportation such as electric bikes, stand-scooters, and other personal mobility devices, there has been a noteworthy increase in the number of users who say they are covered in the event of an accident. As of the current year, more than a third (36%) of micro-mobility users report having some form of insurance or coverage. This represents a significant increase compared to 2022 (+5 pts).

This upward trend may be attributed to a growing awareness of the potential risks associated with micro-mobility devices, leading more users to seek appropriate coverage.

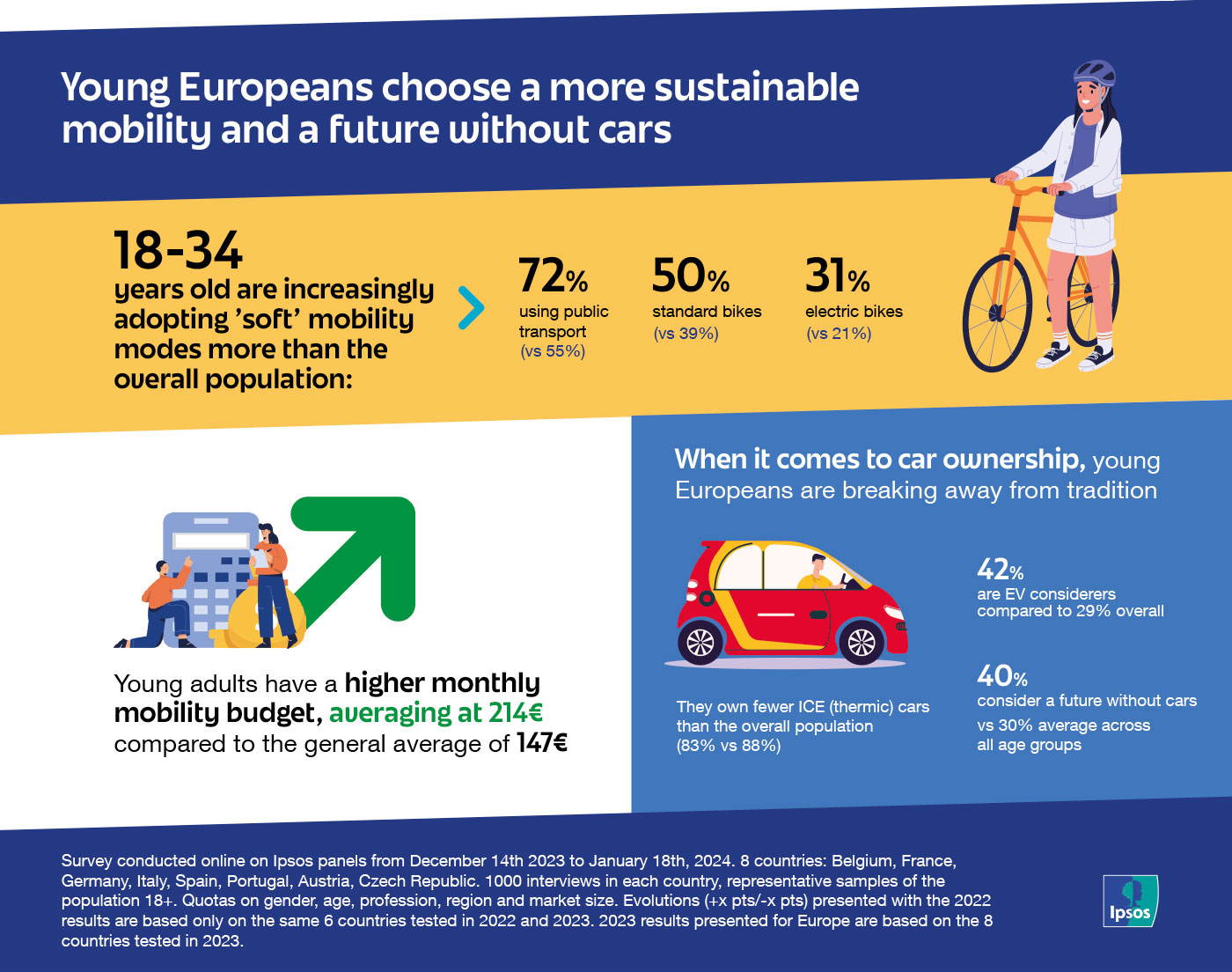

Young Europeans choose a more sustainable mobility and a future without cars

Young Europeans are paving the way towards a more sustainable mobility. The 18-34 years old are increasingly adopting ‘soft’ mobility modes more than the overall population, with 72% using public transport (vs 55% in general population) and 50% standard bikes (vs 39%). The usage of electric bikes is also more prominent in this age group, standing at 31% compared to 21% of the overall population.

Young adults have a higher monthly mobility budget, averaging at 214€ compared to the general average of 147€. This could potentially be linked to their increased use of diverse mobility options.

When it comes to car ownership, young Europeans are breaking away from tradition. They own fewer ICE (thermic) cars than the overall population (83% vs 88%), signaling a shift towards more eco-friendly alternatives. Moreover, 42% of them are EV considerers (compared to 29% among General Population). Looking into the future, youngsters are also more open to the idea of not owning personal cars. 40% of them consider a future without cars (Vs 30% average across all age groups).